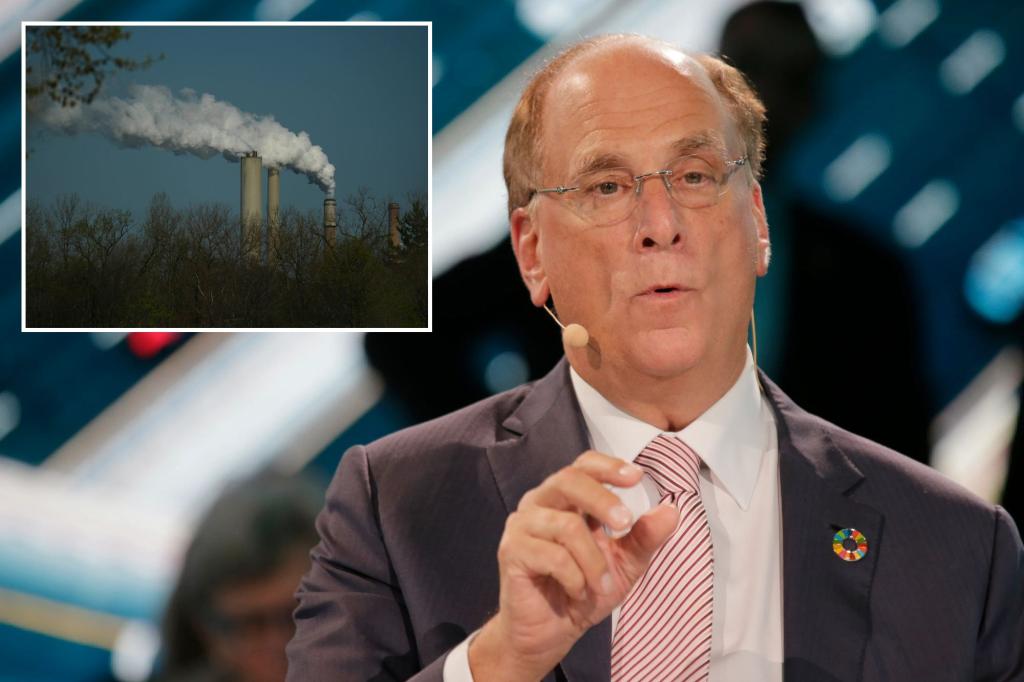

Larry Fink’s BlackRock loses bid to dismiss Texas climate collusion claims

A US judge on Friday largely rejected a request by top asset managers including BlackRock to dismiss a lawsuit filed by Texas and 12 other Republican-led states that said the companies violated antitrust law through climate activism that reduced coal production and boosted energy prices.

US District Judge Jeremy Kernodle in Tyler, Texas, agreed to dismiss just three of the 21 counts in the states’ lawsuit, that also names institutional investors State Street and Vanguard.

The lawsuit is among the highest-profile cases targeting efforts to promote environmental, social and governance goals.

“Despite the plaintiffs’ efforts to advance a new and dangerous antitrust theory, this lawsuit remains baseless and without merit,” State Street said in a statement. Representatives for Vanguard and BlackRock did not immediately respond to requests for comment.

The ruling by Kernodle, who was appointed by President Trump, means the states can move forward with their claims that the asset managers violated US antitrust law by joining Climate Action 100+, an investor initiative to take action to combat climate change, and used their shareholder advocacy in furtherance of its goals.

The companies have denied wrongdoing and called the case “half-baked.” But the states’ theories garnered support from Trump-appointed antitrust enforcers at the Department of Justice and Federal Trade Commission.

The outcome of the lawsuit could have major implications for how the companies, which together manage some $27 trillion, approach their holdings and passive funds.

One possible remedy sought by the plaintiffs would be for the fund firms to divest holdings in coal companies, which BlackRock has said would harm the companies’ access to capital and likely raise energy prices.